The Incorporation Steering Committee posted an 89 page Incorporation Study <click here> and spent two hours presenting bits and pieces of it at Saturday night’s (09-20) public meeting <for Zoom recording click here>.

I want to thank those who brought their time and expertise to the review of the Incorporation Study and the drafting of this assessment.

What you are about to read is a reality check of the Incorporation Study and the information that was conveyed in the public meeting. It takes into consideration the incorporation experience of La Pine, Oregon and the recommended considerations by League of Oregon Cities (LOC) <click here> that were presented on August 28th, though the importantly, relevant sections of that presentation seem to have been overlooked in the posted Study.

Also, as important context for this communication;

- Only two cities have incorporated in Oregon in the past 35 years. La Pine took 4 kicks at the can and, after it incorporated, ran into $55,000,000 of “unintended consequences”(La Pine’s words). The other city, Damascus, fought a successful 7 year legal battle all the way to the State Supreme Court and Governor’s office to unincorporate <click here>.

- The consultant producing the report has only done an incorporation study twice in her long career and none of the Steering Committee members have gone down this path.

The expression, “Is the juice worth the squeeze”, couldn’t be more appropriate when considering the proposal to incorporate an Arch Cape city.

This discussion covers:

- Why are we doing this? (The Juice)

- What is it going to cost us? (The Squeeze)

- “Wish and a Prayer” vs “Fiscal Realities”

- Summary and a Request of the Steering Committee

TO INCORPORATE OR NOT SURVEY: Residents and property owners in Arch Cape, Falcon Cover and Arcadia are invited and encouraged to complete a 30 second incorporation survey – click here. Please forward to friends and neighbors so we can get a representative assessment of preferences.

Executive Summary

*** An executive summary is provided for those that don’t want to slog through the detail below. Given the serious financial impact of the proposal for incorporation, a thorough analysis of that proposal is warranted for those that want to dig in. ***

The Juice – The primary reason that the Steering Committee is proposing to incorporate is to have greater control over land use, but they aren’t specific about what they expect to be different. Short terms rentals will remain. Additional roads might or might not be asphalted/ paved, as has been done over the past 20-30 years. Housing density requirements will continue to be mandated, either by the County or the State. And it is possible that the State could be a more stringent master than the County by requiring rather density rather than allowing it. Too early to tell.

The Squeeze – The Study proposes annual operating costs of an incorporated Arch Cape City that swing widely from $679,000 to $5,000,000 due to the fact that the Steering Committee has yet to decide on the specific services to be provided. These services include potentially unwanted services such as $261,000 for Tourism Promotion. The cost for most, if not all, of these services are grossly understated, apparently in the interest of keeping the property tax rate close to the stated current rate of $1.73 per thousand dollars of assessed value. For the simplest scenario presented in the study, which does not include Tourism Promotion, the cost understatement is estimated at least $250,000 – $300,000, PLUS the additional impact of identified but not budgeted capital costs. The Study states that it does not include the budget projections for anticipated capital costs as “… the legal requirements for an economic feasibility statement do not require a capital budget.” And lastly, the Study and consultant’s comments allude to the fact that forms of taxes other than property tax, such as levies and bonds, may be required.

Bottom line, if an Arch Care City were to be incorporated, property owners would carry a significantly higher financial burden than they do now, along with untold financial risk, for the same or lesser level of service than is provided by the County. And for that burden and risk, property owners would likely get; 1) minimally more, if any, meaningful control over land use, and 2) 5 to-be-selected city councilpersons with the authority to make wide ranging changes to the look and feel of the community (ala the previous Arch Cape Design Review.)

Is the juice worth the squeeze?

Detail

Why are we doing this? (The Juice)

Page 3 of the Study says; “there is interest in the potential benefits of forming a city, especially greater local control”. On Saturday night when specifically asked why incorporate, the Steering Committee response was words to the effect; “The primary underlying reason is …. we don’t have control over land use planning” and went on to say that “Clatsop County has not made the appropriate investments in this community”, which is also echoed on page 3 of the Study.

What does that mean … what will be different if the Steering Committee gets the greater control that it wants?

1. Will Short-Term Rentals be eliminated? Answer: Unlikely, unless tax payers want to bear even higher costs

Short Terms rentals will continue, based upon information presented in the Study. The Transient Lodging Tax (TLT) is essential to pay for the expenses of a city, unless property taxes are to be increased or other taxes levied. Page 79 of the Study states “In the Arch Cape Falcon Cove Beach Incorporation Study, the TLT [Transient Lodging Tax from short term rentals] represents one of the largest potential new revenue sources.” (This is an odd statement as there is nothing potential or new about this tax. Short term rentals have been an age old sore-spot for the Arch Cape Community.)

The charts on pages 86-88 do suggest a possible scenario where short term rentals are eliminated. However, in that case there would be an increase in the property tax rate for all property owners to pay for city services.

2. Will we have Paved Roads and Street Lights? Answer: If additional roads are paved, it would be at the expense of tax payers rather than the specific neighborhoods served.

Roads have been and are being paved and maintained without the incorporation of a city. Cannon View Park, Castle Rock Estates and sections of Pacific Avenue have already done so. It’s unlikely that those communities will be in favor of having their taxes increased to pave other neighborhoods’ roads who do not see the need to dig into their pockets to do it themselves.

Page 68 of the Study outlines the need to upgrade roads – at a cost of $2,600,000 for asphalt roads and $5,000,000 for paved roads. Once ungraded, ongoing annual road maintenance is estimated at $46,000 – $500,000 which includes $1,400/ year for street lights in Arch Cape.

3. Will the allowed use of land be different? Answer: Maybe, but most likely in limited, minimally consequential ways and at a cost of $500,000 – $1,000,000.

During Saturday night’s presentation, the Steering Committee expressed the desire that Arch Cape remain “how it has always been” followed by frustration towards Clatsop county for changing the allowable lot size from 7,500 square feet to 5,000 square feet and for allowing for multi-family structures to support affordable housing. The characterization of the lot size of 7,500 square feet as “always has been” is a mis-representation in that the original lot size in Arch Cape was 5,000 square feet which the County changed to 7,500 square feet in 1979.

The reason for the County’s recent reversal to the original lot size of 5,000 sq ft. and for their allowing multi-family structures is political winds and the State’s legislative requirements for housing density/ affordability (the County answers to its State master). However, the County’s permitted-use allowance requirements are likely to be minimally consequential to Arch Cape due to the geographics of the available land and the economics of the market, specifically:

- Geographic constraints — The limited available land in Arch Cape and surrounding areas naturally restricts the number and size of buildable parcels.

- Market realities — The high cost of acquiring large tracts, coupled with significant construction expenses, means that only a modest number of projects are economically feasible.

- Short-term rental restrictions — With no permits available in the foreseeable future, speculative development aimed at vacation rentals is off the table

- Other zoning and environmental protections — Setbacks, infrastructure limits, and environmental regulations remain in place and will prevent overcrowding.

Also, it is relevant and important to recognize that State legislation is becoming increasingly stringent in requiring, as opposed to allowing, cities to increase housing density. As such the Steering Committee may be short sited in trying to escape the County, as the County could be a kinder and gentler master than the State. It’s all so speculative, only time will tell.

If a city were to be incorporated, State law requires that city to do land use planning. Page 57 of the Study indicates that the start-up cost of comprehensive planning is $500,000 and then $250,000 – $500,000 annually. The deliverable from this expense, beside the plan itself, is land use ordinances, zoning and building codes specific to Arch Cape, all of which need to be managed by the city. Bottom line, by incorporating, the city takes on the responsibility for land use and the residents and property owners will answer to two new masters;

1. The State – who mandates continuingly evolving land use requirements for cities,

2. 5 yet to be named and selected city councilpersons who will likely have a keen interest in controlling many aspects of the arch cape experience in addition to land use (remember the arch cape design review committee).

Also during Saturday night’s presentation, the Steering Committee expressed frustration that; “Clatsop County has not made the appropriate investments in this community. This sentiment is echoed on page 3 of the Study. In recent history, the County gave Arch Cape $250,000 to buy a forest-watershed, the County maintains the gravel roads, built a pedestrian bridge on Pacific and even gave the Community Club $100,000+ for an incorporation study. In my awareness of the recent past, the only specific request that was denied by the County was for $88,000 to upgrade the underground water and sewer infrastructure .

Bottom line, it appears as though the Steering Committee’s objective for going through all this work and spending all of the money outlined below is so that they can exert some minimally more and potentially inconsequential control over land use (and other aspects about the look and feel of this community) though the Study fails to be specific about the type of control that the Steering Committee expects to get.

What is it going to cost us? (The Squeeze)

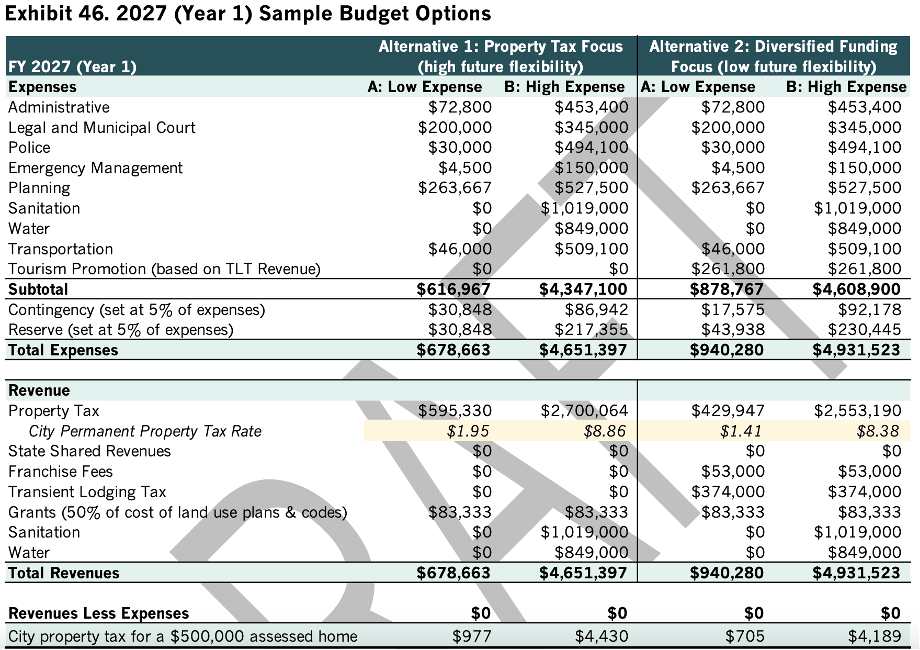

The charts on pages 86 -88 of the Study estimate the incorporation costs as somewhere between $678,000 – $4,900,000. This wide variation in costs is due to fact that the Steering Committee has yet to decide on the exact services that they want the city to provide.

It is important to note that these charts ONLY show the annual operating expenses and NOT the known upfront capital expenses that will be required, i.e., comprehensive plan development, road paving etc. that are detailed elsewhere in the Study.

For simplicity sake, let’s focus on the “Low Expense” Columns 1.A .& 2.A. These columns represent the costs for a very minimal level of city services. (see next section “Wish & a Prayers vs Fiscal Realities” for a reality check on these costs).

From an Expense perspective (top section of the above chart): The only difference between the Column 1.A. & 2.A, is that Column 2.A. proposes that $261,000 be spent on “Tourism Promotion”. As described on page 71-72 of the Study, this means; Operation of a Visitor Center, Production of tourism materials, Creation and installation of interpretative signs , etc.

From a Revenue perspective (bottom section of the above chart): The only difference between Column 1.A .& 2.A is how the costs of the services will be split between what comes out of property owners pockets and short term rental taxes.

| Column 1.A. | Column 1.B. | |

| Property Tax Rate (Per $1,000 of assessed value) | $1.94 | $1.41 |

| Franchise Fees* | $0 | $53,000 |

| Transient Lodging Tax (Short Term Rental) | $0 | $374,000 |

* Franchise fees are charges that cities impose on utility providers—such as electricity, natural gas, telecommunications, cable, and solid waste companies—for the privilege of using public rights-of-way to install and maintain infrastructure like poles, pipes, and wires. They are typically calculated as a percentage of a utility’s gross revenues within the city and are passed on to customers in their bills. Though the property tax rate of $1.41 appears lower, Franchise Fees will be new, additional costs coming out of the residents and property owner’s pockets.

The fine print about taxes …

1. For comparison purposes, the Study talks about the portion of our current property tax that we would no longer pay the County. (This amount would be replaced by whatever amount we pay the City.)

Page 75 – Tax rate of $1.7370 per $1,000 of assessed value. This rate is equal to the sum of the Clatsop County Road District and Rural Law Enforcement District. These taxes would no longer be imposed in the Subareas 1, 2, and 3 (Clatsop County) if it were to incorporate.

2. Both the Study & Saturday night’s discussion suggest that taxes in addition to a permanent tax rate may be required, even though there isn’t a line item on the charts to reflect this likelihood. Page 74 of the Study states: “The new city will have authority to impose property taxes in the form of a permanent rate levy, local option levy, and general obligation bond levy.” The real possibility of these additional taxes was highlighted on Saturday evening when the consultant set the context that most cities are experiencing fiscal crisis as the permanent tax rate doesn’t cover the increase in costs that they are experiencing.

“Wish & a prayer” vs Fiscal Reality

For even greater simplicity, and assuming that there is not wide spread interest by residents in spending money on promoting tourism, this fiscal analysis will only address the scenario of Column 1.A., although the logic applies across all 4 Columns in the table above.

It is relevant to note that Page 9 -‘Conservative Estimates’ of the Study states that the costs projections “leaned towards the higher end.” Page 11 states: “Traditional revenue sources for cities, like property taxes and utility franchise fees, have not kept pace with inflation, leading many cities to either cut spending, eliminate services, or rely on alternative revenues. The [League of Oregon Cities] report notes that cities with fewer than 500 residents (like the potential incorporated city would be) were the most likely to report difficulty meeting their financial needs.

It goes on to say; Because of these constraints, this incorporation feasibility study emphasizes cost structures and revenue composition over nominal figures. The goal is to assess whether incorporation is viable under current conditions and likely fiscal trajectories, recognizing that future city officials will need to adjust budgets based on actual conditions at the time.

In other words, from the Study’s perspective, these are the higher end costs that should be anticipated, i.e., overstated costs as opposed to understated costs.

Below are the fiscal realities that are not being reflected in the above, very bare bones cost scenario of $678,663. Those realities suggest that the real costs to taxpayers will be significantly more. Comparative data and municipal administrative experience estimate that the cost understatement for this scenario is $250,000-$300,000 PLUS the impact of identified but not budgeted capital costs.

Costs are grossly understated:

1. Capital Costs: $3,100,000 – $5,500,000 are NOT INLCUDED in the budget above.

Page 10 of the study states. “… the legal requirements for an economic feasibility statement do not require a capital budget.”.

It appears, that for this reason, the anticipated capital costs that are identified in the Incorporation Study don’t show up as costs that will need to be paid by taxpayer; a) comprehensive planning of at least $500,000, b) asphalt or paved roads and street lights at $2,600,000 – $5,000,000 and c) any construction costs for a city hall/ municipal court, etc.

It would be interesting to know the Steering Committee’s expectations of how, when and by whom these capital costs will be paid.

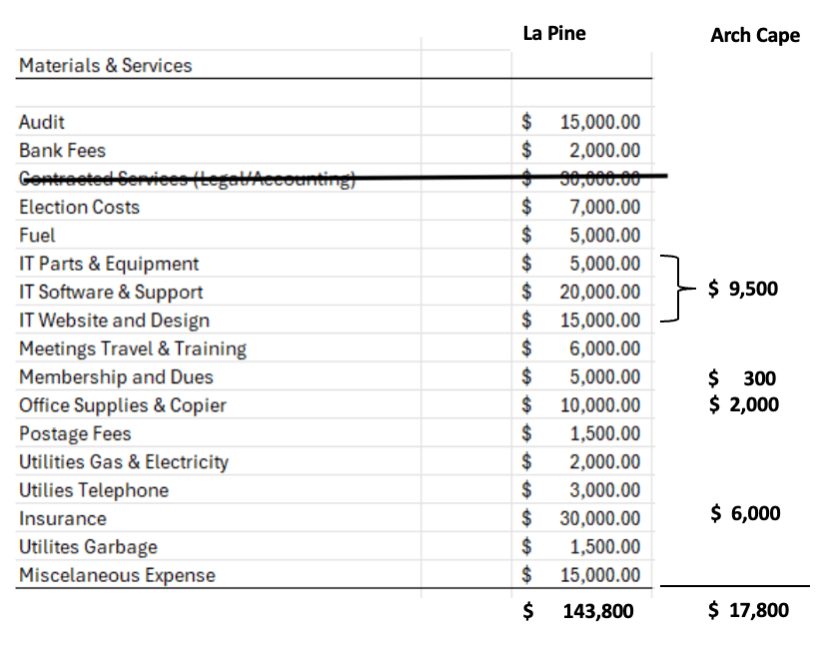

2. Administrative Costs: Arch Cape City’s proposed budget – $72,000. La Pine’s actual budget – $408,000.

Page 44 of the Study estimates that a new city can be administered with a $55,000 staff contract and $17,800 of expenses.

Staff Expenses: Arch Cape City – $55,000. La Pine – $175,000

If a new city’s contracted staff person only worked 20/hr per week, their hourly rate would be $52.88 and at 40 hr/ week the rate would be $26.44/ hr.

Is it reasonable to believe that a qualified, experienced person whom we could trust to create and administer a new city would be willing to do so for this low hourly rate?

Real world comparisons;

- The Water District pays almost $160,000 for two part time contractors to administer both the Water & Sewer Districts. These Districts are well established, and the administration of these Districts is less complex than the creation and administration of a new city, when all new contracts/agreements and processes need to be put it place.

- La Pine hired 2 full time people. Salary was $175,000 which is an average hourly rate of $84 between Administrator and Clerk

Non-Staff Expenses: Arch Cape City – $17,800. La Pine – $143,000

With the exception of Insurance & Utilities, La Pine’s costs would likely require only minimal adjustment based on the size of an Arch Cape City.

Note: La Pine’s operating budget was presented to the Steering Committee on August 28th, though these line items are not reflected in the Arch Cape City budget.

3. Police Costs: Arch Cape City budget: $30,000. County Sheriff is $144,464.

Page 48 of the Study lists the public safety policing services that would need to be provided by the new city. These services are in addition to other policing services – page 47 – that will continue to be provided by the County Sheriff to an Arch Cape city and throughout the County.

Pages 49-50 of the Study proposes that a new Arch Cape City contract with Manzanita for 20 hr/month of “limited supplemental patrols” at an annual cost of $30,000. This is based on the IGA between Manzanita and Nehalem which are adjoining cities. The Study does not reference any specific discussion with Manzanita about providing these services to an Arch Cape City.

To provide these public safety services listed on page 48, the Sheriff’s Office estimated that a contract for .5 FTE (approximately 20 hours per week) would cost $144,634.

4. Contingency/reserve amount: Arch Cape City budget: $62,000. GFAO Recommendation is $136,433 (based upon more realistic costs)

The Study proposes contingency/reserve amount at less than 10% of expenses rather than the 16.7% recommended by GFAO

The Government Finance Officers Association (GFOA) recommends that local governments maintain a minimum unrestricted fund balance in their General Fund of at least two months of operating revenues or operating expenditures, which is approximately 16.7%. This reserve acts as a financial safeguard against unexpected events, such as recessions or disasters, and should be adjusted upwards for governments with more volatile revenues, higher exposure to disasters, or other significant risks.

Revenues are optimistic

Grants are assumed at $83,333, though the Study doesn’t specify the costs in pursuing those grants nor the likelihood of them being awarded. Experience with the Water and Sanitary Districts suggest that grants are difficult to get and aren’t even assured after they are awarded, e.g., the FEMA grant for the Webb Lift Station.

Does this budget pass the “sniff test”? Aside from the omitted and understated costs specifically highlighted in #1-4 above, are the estimates for the other costs realistic? In your experience, have estimates ever been right-on or less than actual costs, e.g., home building, renovation, car repairs, whatever? Typically, the higher the complexity of the work, the higher the over-budget cost. Likely, incorporating a city is not different, and it is definitely highly complex.

The presented budget for the barebone services, Column 1.A. has a permanent tax of $1.95 which is more than our current permanent tax rate of $1.73. When the associated service costs are updated to reflect reality, the out-of-pocket costs for property owners will increase significantly. And this fiscal chasm only gets worse if/as the city provide more than the barebones service.

Summary & a Request for the Steeting Committee

The track record for incorporation is daunting. Only two cities have made it through the gauntlet in the past 35 years and only one continues to survive. La Pine had multiple kicks at the can, was knowledgeable and prepared and they still ran into significant unexpected financial problems after incorporation. In comparison, the Incorporation Study has no meaningfully, actionable objective, no description of how the community will be different after incorporation, includes expensive and unwanted services that will come as an unwanted surprise to the community, and omits significant costs and understates others so that the permanent property tax can be kept as low as possible to increase the likelihood that a possible future ballot measure might be successful.

If an Arch Care City were to be incorporated, property owners would be carrying a significantly higher financial burden than they are now and untold financial risk. And for that burden and risk, property owners would most likely get; 1) Minimally more, if any, meaningful control over land use, and 2) 5 to-be-selected city councilpersons with the authority to make wide ranging changes to the look and feel of the community. Moving forward in this direction will likely take the community on the same path as Damascus with 7 years of legal entanglements.

If this effort concludes now, maybe the remaining incorporation study money can be spent on repairing our underground water and sewer infrastructure rather than a consultant and, even better, the next year of our lives is not spent wrestling with this incorporation issue.

If the Steering Committee chooses to continue to push their incorporation agenda, it would be helpful if the next version of the Incorporation Study would remove the complexity and make this all very simple by clearly answering the following questions:

- What specific aspects of land use planning does the Steering Committee believe that they will be able to control and how will the community be different than it is now?

- What are the Steering Committee’s expectations of how, when and by whom the capital costs will be paid and what will be the financial impact on the budget and the taxpayers?

- What is tax rate that we will no longer pay to the county, e.g., $1.73 per thousand dollars of assessed value.

- What is the proposed permanent property tax rate that we will pay the new city?

- What are any out-of-pockets costs, other than the permanent property tax rate that the property owners will incur?

- What are the services that the residents of a new Arch Cape City will get that they are not already getting?

Only then will we each be able to judge for ourself if the juice is worth the squeeze.

TO INCORPORATE OR NOT SURVEY: Residents and property owners in Arch Cape, Falcon Cover and Arcadia are invited and encouraged to complete a 30 second survey – click here. Please forward to friends and neighbors so we can get a representative assessment of preferences.

One response to “Fact Check: Is the Juice Worth the Squeeze”

Jeeze! Bill, this is so you and we thank you!

TD

LikeLike